How To Protect Your Retirement from Inflation

How To Protect Your Retirement from Inflation

As financial advisors, we work closely with our clients at Altfest Personal Wealth Management to understand their overall financial circumstances. That includes understanding the different sources of their income, their assets, their liabilities and their expenses through the various phases of life.

When it comes to retirement planning and budgeting, it’s critical to appreciate and adapt to one of the biggest challenges you’ll face: inflation.

How Inflation Affects Your Retirement

By definition, inflation is a general increase in prices and a fall in the purchasing power of money. While the high level of inflation that we’ve experienced over the last few years has received a lot of attention, even a more modest rate of inflation is something that requires intentional planning.

Over the last 50 years, inflation in the U.S. has averaged between 3% and 4%, with periods that have been higher as well as extended periods that have been lower. Over time, this near-constant inflation can meaningfully erode what each dollar you have can purchase. I don’t want to give the impression that inflation is necessarily always a bad thing: The existence of a modest amount of inflation is indicative of a healthy economy. But it can never be ignored.

That slow burn of inflation really adds up over time. As an example, according to U.S. Bureau of Labor statistics, a basket of food that cost about $20 in 1974 would cost nearly $120 now. The growth didn’t happen overnight, rather little by little. It’s for that reason, the accumulating impact of inflation over time, that we really need to pay close attention to this topic.

The long-term impact of inflation will be felt because you may spend many years in retirement, perhaps even more than you expect. For most people while working, their income from their job pays their bills. With such income, you’ll often receive a pay increase over time that’s tied to inflation. However, in retirement, for most people, it’s necessary to rely more heavily on savings and there’s no innate inflation adjustment to that.

Another factor to recognize is that the types of retirement plans available to private-sector workers have changed significantly over time. Defined benefit, or traditional pension, plans in which you receive payments during retirement based on your years of service to your company are increasingly rare. Defined contribution, sometimes called DC, plans, like a 401(k) or a 403(b), are essentially an investment account that you fund yourself through withholding from your pay and invest over time.

In addition to the prevalence of defined contribution plans in the workplace today, Social Security payments usually only replace a minority of a worker’s income in retirement. Given this backdrop, it’s your savings, retirement and other types of accounts that you’re going to need to rely on for financial support in your retirement.

In addition, the potential for extended longevity exacerbates the accumulating blow of inflation over time. As a financial advisor, I work with many clients who are in their late 80s or 90s and they’re still going strong, spending decades in retirement.

Positioning Your Portfolio for Future Inflation

We speak with many people about their savings as they approach retirement and their perception is that they should move all or most of their savings to low-risk investments. The thinking is that people entering retirement no longer have the capacity for taking on risk. While that idea does have some prudence, it ignores the eroding impact that inflation has on the purchasing power of your uninvested assets over time.

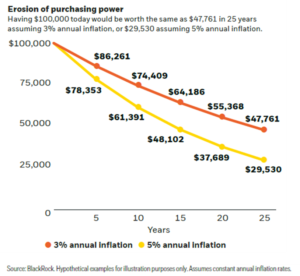

At 3% inflation, $100,000 will buy you about half as much over a 25-year period and at 5% inflation, less than one third over that 25-year time frame. To counteract this, it’s important to have your assets grow at a rate of return that can keep up with, and hopefully exceed, inflation. In the line chart below, you can see the impact of inflation at 3% and at 5% over 25 years on a stockpile of cash. The orange line is 3% and 5% is denoted by the yellow line.

The problem with stockpiling all your money in the lowest-risk investments is that generally they’ll not be able to earn a return for you over time that’s sufficient to combat inflation. Cash or equivalents and some types of low-risk bonds are examples of low-risk investments that many retirees consider but that may not necessarily be the best inflation-fighters.

By contrast, a diversified portfolio has been a reliable approach to outpacing inflation over time. The return from a diversified portfolio has consistently exceeded inflation by a wide margin over most time periods. Based on that, we recommend to our clients that a prudent way to withstand inflation is to invest a meaningful amount of their assets in a diversified portfolio comprising a mix of investments that you can expect to be resilient through many different types of market environments.

Taking on Inflation Through Financial Planning

What are some of the recommended assets in a diversified portfolio? Although cash or equivalents and the like have limitations when it comes to fighting inflation, as I mentioned, there are many other good choices when it comes to building a diversified portfolio. To list a few, higher-risk U.S. and international stocks deserve a place in your portfolio. That’s because you need those kinds of investments to generate the return required to outpace inflation.

However, you don’t want to have all your eggs in one basket in terms of stocks. While there are many different kinds of bonds that could be sensible to include in your portfolio for their income and safety characteristics, certain types of bonds are particularly well-suited for periods of inflation.

For example, one type of bond that really is purpose-built for inflation is TIPS, an acronym for Treasury Inflation-Protected Securities. These types of bonds were first made available in 1997.

Bonds are typically structured as an IOU because you lend the borrower a certain amount of money and they promise to pay you back that money with a fixed rate of interest at some point in the future. With TIPS, rather than the borrower promising to pay you back the amount that they borrowed, the amount that they pay you back is increased to reflect inflation at that time and the interest rates adjust to reflect that as well.

Another asset we’ve been partial to that can provide a hedge against inflation is infrastructure investments. Infrastructure-related assets are one type of “alternative” investment, and can include companies involved with electricity, gas, water, transportation, communications and other investments. Broadly speaking, infrastructure investments consist of physical assets that are acquired for economies and societies to function. Over time, infrastructure investments have been able to provide consistent returns and much of that comes from the income that they pay, which helps cushion the blow of price swings during volatile times.

Alternatives can be a valuable way to diversify your portfolio for many reasons, but some types of alternatives like these infrastructure investments are particularly well-suited for inflationary periods.

The Key to Beating Inflation

Making calculations for the future is really an iterative process, and it’ll evolve over time. The inputs need to change as your situation changes. However, in addition to your individual circumstances, as a starting point, we also make estimates for rates of return and inflation. To establish these assumptions, we pick a specific level based on history and other factors. However, that best guess remains an estimate.

To address this uncertainty, we employ a statistical process called Monte Carlo in our analysis. Rather than using just one rate of return and inflation, we use a range of them. We then run the analysis many times to see the impact of varying returns and inflation scenarios. With all those possible outcomes, you can calculate an associated probability of success of your assets and income meeting your needs over time, whether inflation is higher or low, or returns do or don’t match what you might expect.

Find Out More

At Altfest, we work hard to understand who you are and what matters to you from the first consultation. We want to learn about your concerns or special circumstances that will affect your retirement planning. Then we’ll put together a road map to help you get to where you want to go.

If you’re not yet an Altfest client, please book some time for a complimentary consultation.

Investment advisory services provided by Altfest Personal Wealth Management (“APWM”). All written content on this site is for information purposes only. Opinions expressed herein are solely those of APWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

David Kressner, CFA, CFP

David advises clients to help them meet their financial goals and is responsible for research on sustainable investments for the firm. He has more than 25 years of extensive experience with investment research and managing portfolios of mutual funds, stocks, and bonds on behalf of individual investors. In addition to Altfest, David has also worked for JPMorgan and AssetMark.

David earned a BA in Economics from Emory University, holds the CFA and CFP® designations, and is a member of the CFA Institute and CFA Society New York.