Thoughts on the Market: The Impact of Unemployment

Thoughts on the Market: The Impact of Unemployment

The weekly U.S. Jobless Claims published this week topped approximately 2.4 million. The latest data suggests that approximately 28 million Americans were unemployed in May, which is equivalent to approximately 20% of the civilian workforce being out of work.

The cumulative new weekly claims since the beginning of the outbreak, however, add up to approximately 38 million. We infer that about 8-10 million who lost jobs due to COVID-19 got rehired back, at least on paper.

The Payroll Protection Program (PPP) conditions requiring employers to keep their workforce employed may explain why some 8-10 million are no longer claiming unemployment benefits.

In any case, the vicinity of 20% unemployment in the United States is still a dire number. To provide context: 20+% unemployment was last observed during the Great Depression era in 1932-1935, which peaked at about 25% in 1933. During the Great Recession era in 2009-2010, unemployment was about 10%.

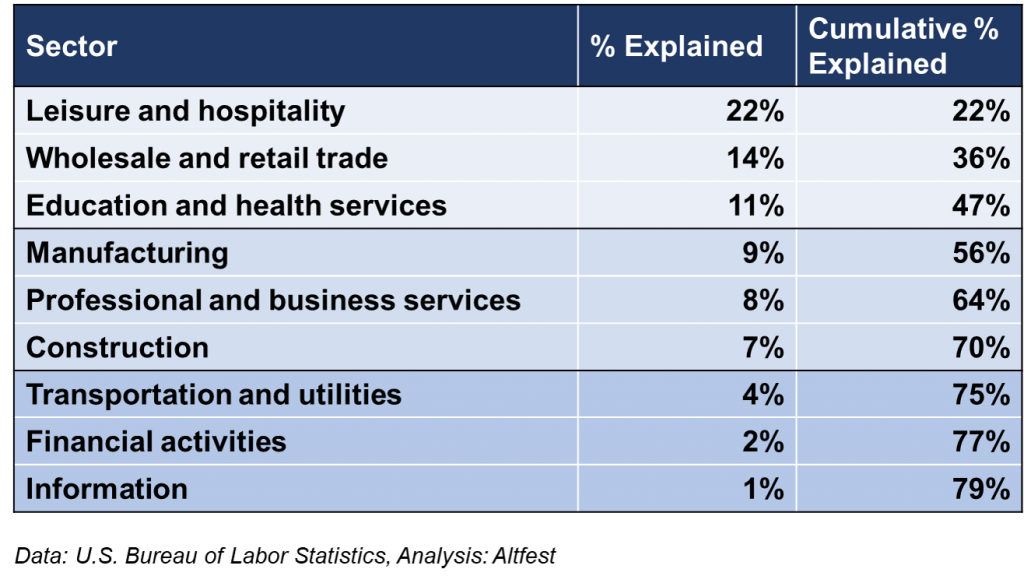

Using more granular data published by the Bureau of Labor Statistics, we guesstimated the composition of this chilling unemployment stat: it looks like the top three sectors account for almost 50% of the 28 million Americans unemployed.

So what?

The statistics indicate by and large that low wage workers likely constitute a lion’s share of the economic victims during this pandemic.

The sector breakdown may partially explain why the market looks like a winner-takes-all, where we see high concentration of the rebound returns within certain subsectors of the financial market that underwent sudden precipitous shock at the start of the outbreak and have recovered well since.

The financial sector stands out in the sense that its stock market recovery remains anemic even though the actual job losses within the sector are close to non-existent. This is likely due to market fear that the sector is heavily exposed via the credit channel to the above top sectors and thereby likely to absorb much of the shock emanating from the troubled businesses and distressed consumers who are economic victims of the outbreak.

The most-impacted sectors are expected to resume as soon as the self-imposed quarantine period is over. So, some critical questions are:

- When is the quarantine going to be over?

- How safe would it be when the economy reopens?

- At what capacity are restaurants and retail going to run post-quarantine in 3 months, 6 months, etc.?

These low wage categories in the labor force, the primary economic fatalities of the shock, also happen to be part of the population that has the lowest safety buffer and need extraordinary support from the government for such unforeseen emergencies. Therefore, the government debt load would continue to swell unless the implicit social contract is broken that constitutes the basic handshaking mechanism between the Haves and the Have-Nots in a well-functioning socioeconomic fabric.

Either way, the categories also explain why it may not “feel like a recession” from within the asset market perspective – very little impact on the service industry-centric white-collar workers, unlike other recessions that usually span across industries and sectors.

Beyond the obvious this brings us to some interesting questions:

Is the financial sector, and by extension the value stocks, undervalued? In other words, are credit losses for the financial sector going to be as severe as their market prices imply?

If not, are certain other parts of the market too optimistically priced?

Are the severely beaten down labor-sectors (Leisure, Retail etc.) going to rebound soon or not?

What is to be expected if they do not rebound fast? Are other sectors going to continue to thrive?

Importantly, how long would the government have to cover the approximately 20% unemployment? How would it be financed?

Possibly by higher borrowing via Treasury issuances or, rolling back some of the corporate tax breaks or, a combination of the above?

Incidentally, pre-COVID-19 outbreak, the Treasury was already looking for a new sweet spot (20y) on the yield curve to borrow more in order to finance deficits.

Post-2017, Corporate Tax Breaks helped U.S. corporations and even spurred a market rally. But the Treasury had to look for other sources of financing to balance the budget. It appeared to have plans to cover some of that via new borrowings through the Treasury bond issuance channel.

Now the need for borrowing has been further amplified to cover the economic shockwave due to COVID-19.

Of course, most of the Treasury issuances would be bought out by the Fed. The Fed buying treasuries or other assets is a necessity, and the Fed has been beyond generous to have carried out this role. But beyond an extent it would be equivalent to a printing-money-out-of-thin-air scenario which would be instructive of the U.S. Dollar’s resilience in the short-to-medium term.

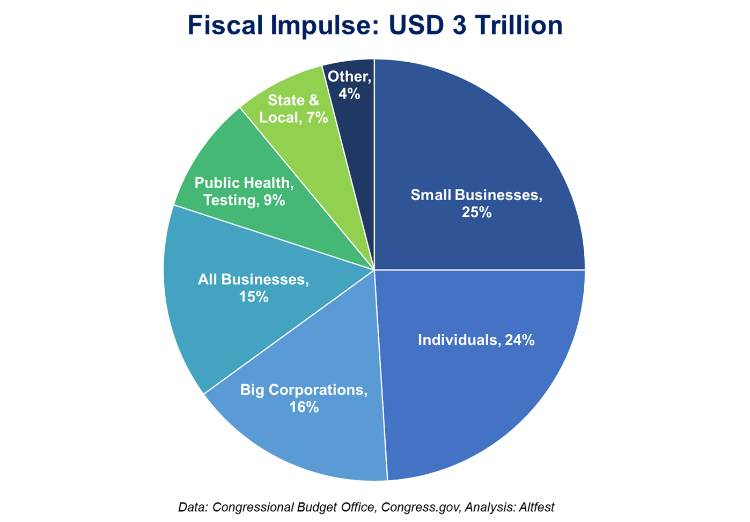

The U.S. government has already footed a large bill with an approximately $3 Trillion rescue package. The question is how much more to go, how would it be financed, what would be the repercussions on future growth, and thereby the impact on the capital markets?

The corner stores are the cornerstones of our economy. That is because the U.S. economy is predominantly consumption-driven, and not only do corner stores form the final leg in the consumption supply-chain, but the corner store owners and workers also constitute a large chunk of the consumer base. The amount of activity and health of the corner store, despite the rocket-ship-like take-off of Amazon Fresh and other delivery services, would continue to be an important barometer for the economy. The re-opening of the stores at the corner of our streets would also incidentally be a signpost of a narrowing reality-gap between the Main Street and the Wall Street economies. Consequently, their ability to re-open and stay open is critical to our economic health.

Interested in speaking about your investment portfolio or another area of your personal financial life? Contact your Altfest wealth management team or schedule a complimentary consultation at this link.

Sush Poddar, MBA, is an Investment Strategist and Portfolio Manager at Altfest Personal Wealth Management. Prior to joining Altfest, she was an Executive Director at a large investment bank. She holds an MBA in International Finance from Thunderbird School of Global Management at Arizona State University.

*All numbers are approximations

The foregoing content reflects the opinions of Altfest Personal Wealth Management and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Past performance is not a guarantee of future results. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Investment advisory services provided by Altfest Personal Wealth Management (“APWM”). All written content on this site is for information purposes only. Opinions expressed herein are solely those of APWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

Sush Poddar, MBA

Sush focuses on enhancing Altfest’s active investment strategy initiatives and developing custom portfolios tailored to specific client needs. She brings a deep expertise in global macroeconomic analysis and multi‐asset class strategies. Sush joined the firm from Morgan Stanley, where she was a strategist and Executive Director in global macro trading.

Her prior work experiences include equity research at Standard & Poor’s Global Markets Intelligence and investment analysis at Goldman Sachs Private Wealth Management. Sush earned a BS in Computer Science and Engineering from Osmania University in India and an MBA in International Finance from Thunderbird‐Arizona State University.