Who Says Bonds Are Boring? Three Fresh Perspectives Now

Who Says Bonds Are Boring? Three Fresh Perspectives Now

As you may know, the bond market has been a lot more volatile in recent years. In 2020 and 2021, our firm, Altfest Personal Wealth Management, as well as some other professional investors, didn’t think that bonds represented good value overall, except for bonds with very short maturities and inflation- protection features.

But now, our outlook on bonds is quite different. I’d like to share ideas with you about some more attractive opportunities in bonds that we’re seeing and recommending. I’ve worked for a number of years as a managing advisor at Altfest, regularly discussing bond investing with our clients. For this post, let’s examine:

- How the bond market has evolved in recent years,

- How bonds got to where we are today, and

- A glimpse of Altfest’s current bond strategy and what that could mean for your portfolio.

The Recent History of Bond Investing

The wild interest rate swings that we’ve seen over the last few years as the Federal Reserve has worked to cool inflation by boosting interest rates have really created chaos in the bond market — and more turbulence than normal, even for a diversified portfolio. While this excitement hasn’t always been enjoyable or appreciated, the bond market has been far from boring.

In fact, bonds have ended up being right at the tip of the spear where the economy meets the investment markets. This is attributable primarily to the important role that interest rates have played as a tool in government policy, initially in response to the pandemic and then later to fight inflation. I hope a brief history lesson gives you some understanding of the factors that drive the bond market and create the risk and opportunity now posed for part of your portfolio.

The fed funds rate is one of the most important interest rates in the U.S. and it influences the cost of borrowing across the economy. The Fed reduces rates to accelerate growth in the economy when it’s lagging, but then it increases interest rates to slow growth when the economy is running too hot.

We’ve experienced a dramatic whipsaw in interest rates over the last several years. In response to the pandemic, the Fed cut its rate to near zero in March of 2020 and then kept it there for about two years until March of 2022. This prolonged period of very low interest rates kept the economy afloat during the temporary worldwide health crisis. However, all the economic stimulus was not without some undesirable consequences.

Chief among those was very high inflation, as consumer demand fueled by lower interest rates, supply-chain issues and other factors pushed inflation to a peak of 9.1% in June of 2022. That was the highest level of inflation that we had seen in four decades. In response to these rampant price increases between March of 2022 and July of 2023, the Fed reversed its course eventually and raised interest rates by 5.25 percentage points, also the fastest rate of increase that we had seen in about 40 years.

These dramatic changes in interest rates over this relatively short period, first down and then up, are important because interest rates and bond prices move in the opposite direction.

How Interest Rates Affect Bond Prices

I think the best way to grasp the relationship between interest rates and bond prices is with an example.

If you imagine yourself as a bond buyer and interest rates are rising, you’ll have the choice to buy a bond issued last month that offers a lower interest rate or a bond issued today at a higher interest rate. In that situation, which is best to choose?

In most cases, the bond issued today. The reason is because it costs less. As a result of this market dynamic, higher interest rates result in lower prices for existing bonds. The opposite holds true when interest rates decline. In a declining interest rate environment, prices will go up for existing bonds that offer interest rates above what you can get for a bond that’s issued today. Now you have a sense of what drives these market swings.

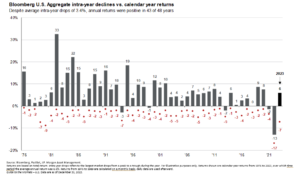

Let’s take a look at the implications of such economic activity for bonds within your portfolio. Recently, we’ve seen drops in bond returns that really have very little precedent. In the chart below, each of the gray bars represents the annual rate of return for U.S. bonds over the last 50 years.

The red dots indicate the largest intrayear percentage fall for bonds in that calendar year. So, for example, starting all the way on the left, in 1976, bonds increased in value by 16% and the largest intrayear decline was just 1% in that year. If you look at the period up until 2021, you get a sense of why people usually don’t spend much time talking about bonds. Because in recent memory, their returns have been quite dull.

Over that 20-year period, bonds consistently generated returns in the mid-single digits with intrayear dips that didn’t exceed 5%. Investors were lulled into a sense of security and serenity in the bond market by this tranquil activity over a fairly long stretch.

But beginning in 2021, the bond market began to show signs of weakness with a modest decline of about 2%. Then the brute force of recent interest rate hikes by the Fed hit the market in 2022, when high-quality U.S. bonds dropped by 13% and were down by as much as 17% at certain points during the year. Looking back over the last 50 years, there’s really no comparison to that level of decline in the bond market.

In very short order, bonds went from being the investing equivalent of watching paint dry to something very different from that.

Where Bonds Stand in 2024

Looking ahead, we at Altfest don’t think bonds are obsolete. We expect that they will play an important role in a portfolio, both while you’re working and then as you enter retirement. Last year, bonds began to redeem themselves, but they weren’t completely out of the woods yet.

Understanding that bonds play an important part in your portfolio, the last few years have clearly shown us that we can’t ignore them, even in tough times, without risk to your portfolio. When Altfest looks at the current economic conditions, we’re cautiously optimistic about bonds in general.

However, we recommend a selective approach when making investments in this asset class to be mindful of remaining risk and the role that you expect them to play within your portfolio. Expectations for slowing economic growth and moderating inflation support our outlook for bonds going forward.

While there’s some uncertainty about the direction of inflation from here, we think it’s most likely that the worst is behind us and that price increases should stabilize at a lower level. The runaway inflation and sharply higher interest rates in 2021 and 2022 did a lot of damage to the bond market, as we’ve seen. While bond prices recovered somewhat in 2023, we think a few chances are out there now to achieve an attractive return in the bond market, without taking on undue risk.

Some Bond Market Opportunities Now

I’ll highlight two areas where there’s opportunity, if you have the expertise and ability to navigate these complex markets.

For instance, municipal bonds can offer a lot of value if purchased in an informed way. As background, municipal bonds, also known as “munis,” are debt issued by states, cities and other government entities to fund day-to-day obligations and to finance capital projects such as building schools or sewer systems. Generally, interest rates paid by munis are exempt from federal, state and local taxes if you reside in the state where the bond is issued.

This privileged tax treatment across three forms of government taxation is often referred to as triple tax exemption. As you can imagine, the tax advantage offered by muni bonds can offer significant value to individuals that are in a high tax bracket, particularly those who reside in states that have a high state income tax. The attractiveness of the option to lock in tax-adjusted yields for high-quality bonds in your portfolio is much greater now than it was a few years ago.

While municipal bonds currently are interesting, we caution that it’s a market that requires certain access and skill to take full advantage of. Bonds and stocks trade differently from one another. Stocks of most large to medium-sized, and even small, companies, are liquid while trading on an exchange. Bonds trade on a negotiated basis, so two investors buying the same bond at the same time can pay very different prices for that same investment. Generally, institutional investors have direct access to the bond market.

For individual municipal bonds that we buy, we think of them as the safe money within our clients’ portfolios. We want those bonds to generate an attractive level of income, but also to form the bedrock of your portfolio and to provide it with stability when the stock market waivers. We do that by focusing on very high-quality individual municipal bonds with the lowest probability that the issuing entities might not be able to repay their interest and principal.

There’s also one more area of the bond market I’d like to highlight in the current environment. Some of the higher-risk parts of the bond market include high-yield corporate bonds, and certain types of mortgage-backed bonds.

We think that by casting the net wider — beyond high-yield corporate bond issuers — there is an opportunity among certain high-yielding mortgage-backed bonds to get exposure to higher interest rates without excessive risk. For this narrow slice of the mortgage bond market, we believe the return justifies the risk. A mortgage-backed bond, as the name implies, consists of a bundle of home loans bought from banks that issue them. Basically, the payments that you receive when you own a mortgage bond are the interest and principal payments being made by a pool of homeowners.

We think that an investment opportunity exists within a very specific class of mortgage-backed bonds, those composed of loans made to homeowners that predate the financial crisis of 2008 and 2009. The yields available on these bonds are currently about 9%. Fifteen years removed from the global financial crisis, the individuals holding these mortgages have a long history of making on-time payments.

However, a caveat: We don’t encourage an individual investor to venture into this area without guidance. For that reason, we’ve spent a significant amount of time identifying the best way to access this market for our clients.

Find Out More

At Altfest, we work to get to know who you are from the first consultation. We seek to find out what financial concerns are most important to you. One solution may involve adjustments to your portfolio’s bond allocation, using some of the strategies discussed above.

Once we gain a solid understanding of your situation, we’ll put together a road map to help you get to where you want to go.

If you’re not yet an Altfest client, please book some time for a complimentary consultation.

Investment advisory services provided by Altfest Personal Wealth Management (“APWM”). All written content on this site is for information purposes only. Opinions expressed herein are solely those of APWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

David Kressner, CFA, CFP

David advises clients to help them meet their financial goals and is responsible for research on sustainable investments for the firm. He has more than 25 years of extensive experience with investment research and managing portfolios of mutual funds, stocks, and bonds on behalf of individual investors. In addition to Altfest, David has also worked for JPMorgan and AssetMark.

David earned a BA in Economics from Emory University, holds the CFA and CFP® designations, and is a member of the CFA Institute and CFA Society New York.